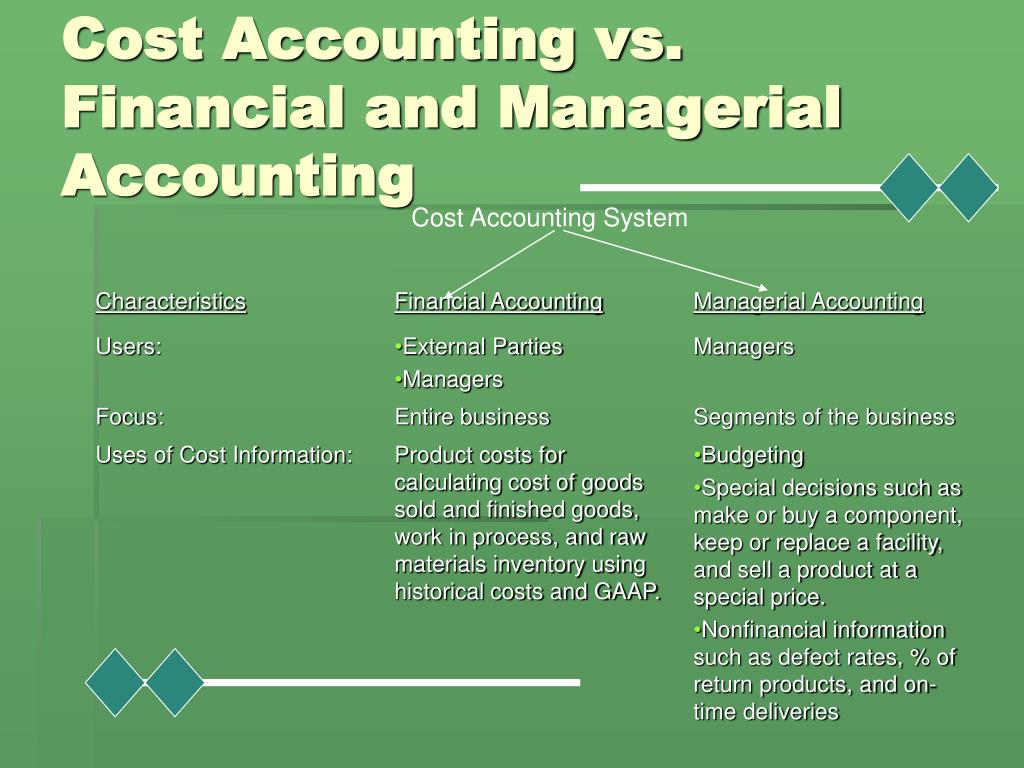

Although accounting is a broad concept, financial and managerial accounting are two of the most commonly used methods. They serve different purposes and often work together to represent a business’s correct financial outlook. However, to ensure informed decision-making, it’s necessary to understand the differences between financial and managerial accounting. Financial accounting, on the other hand, requires an eye for detail and an ability to adhere to strict guidelines. It involves presenting data understandably and thoroughly primarily to external stakeholders.

Get A Clear Picture With Managerial And Financial Accounting

We may earn a commission when you click on a link or make a purchase through the links on our site. In actual practice, it is difficult to classify information as being either exclusively financial or managerial. The two accounting systems are part of the total business system and, for this reason, they normally overlap. Financial accounting information is designed primarily for use by persons outside the firm, including creditors, stockholders, owners, governmental agencies, and the general public. Located in Coral Gables, Florida, the University of Miami (UM) is a private, research university.

IT Degree Salary: How Much Do IT Managers and Other Professions Make?

Financial accounting primarily focuses on the financial health of the company and provides information for external stakeholders such as investors and creditors. In contrast, managerial accounting focuses on the internal operations of the company and provides information for managers to make decisions. Financial accounting focuses on the preparation of financial statements for external stakeholders. Meanwhile, managerial accounting is concerned with providing information to internal stakeholders for decision-making purposes.

Managerial Accounting vs Financial Accounting: Reporting Conventions

- However, to ensure informed decision-making, it’s necessary to understand the differences between financial and managerial accounting.

- It can bring down the cost of production through alternative suppliers and offer the same dress for $10.

- Business managers are responsible for collecting data that enables them to engage in strategic planning, assists them in establishing attainable goals, and facilitates the effective direction of corporate resources.

- Understanding and analyzing financial ratios is equally critical here, mainly the current ratio (current assets divided by current liabilities), which measures liquidity.

- Financial accounting information is designed primarily for use by persons outside the firm, including creditors, stockholders, owners, governmental agencies, and the general public.

- Moreover, financial statements are released on a regular schedule, establishing consistency of external information flows.

Calculating inventory turnover can help businesses make better decisions on pricing, manufacturing, marketing, and purchasing new inventory. A managerial accountant may identify the carrying cost of inventory, which is the amount of expense a company incurs to store unsold items. Managerial accountants calculate and allocate overhead charges to assess the full expense related to the production of a good. The overhead expenses may be allocated based on the number of goods produced or other activity drivers related to production, such as the square footage of the facility. In conjunction with overhead costs, managerial accountants use direct costs to properly value the cost of goods sold and inventory that may be in different stages of production. This is not typically the case in management accounting since there are many different reasons each organization should perform certain tasks in a particular manner.

Financial Statements and Reports

An example would be an internet company that uses cloud computing services for its employees. This uniformity allows investors, lenders, and analysts to compare companies directly on the basis of their financial statements. Securities and Exchange Commission (SEC), establishes financial accounting rules in the United States. The sum of these rules is referred to as generally accepted accounting principles (GAAP). Download our free Guide to Finance and Accounting to explore the financial skills all managers need.

Management accounting is a field of accounting that analyzes and provides cost information to the internal management for the purposes of planning, controlling and decision making. Because management accounting is not meant for use by third parties, it may be adapted to better serve the requirements of those who are supposed to be using it. This may vary significantly from company to company and even from department to department within the same organization. Investors and lenders are able to make direct comparisons across firms based on the basis of their financial statements because of this standardization. Additionally, financial statements are published according to a predetermined timetable, establishing uniformity in the flow of external information.

Since management accounting is not required by law, the reports prepared by management accountants are subject to cost-benefit analysis (i.e., the perceived benefits of the report should exceed the costs). In addition, financial accounting information is historical in nature, where financial accounting reports concentrate principally on the results of past decisions. While financial accounting looks at the past by analyzing financial information, managerial accounting looks at the future by examining financial information to make forecasts. However, this doesn’t mean that financial accounting only looks to the past, as investors and creditors use financial statements to make their own forecasts. Financial accounting must follow certain standards in accordance with GAAP, which is a requirement for businesses based in the U.S. to maintain their publicly traded statuses. Managerial accounting is not intended for external users and can be modified according to the company’s processes.

One of the main functions of managerial accounting is to estimate future costs, such as production, marketing, inventory, shipping, and R&D. Another benefit is supporting ongoing adjustments to the strategic plan based on real-time data. As external conditions change (changing consumer trends or economic policies), managerial accounting provides you with the right tools to re-assess and modify strategies accordingly.

For financial managers, a job category that overlaps managerial accountants, top job candidates have a master’s degree in business administration, finance, accounting or economics. People who have been trained in financial accounting have a Certified Public Accountant designation, while those with a Certified Management Accountant designation are trained in managerial accounting. Financial accounting reports analyze what happened over a specific time period without making recommendations for the future. Also known as “Management Accounting,” managerial accounting focuses on gathering, measuring, and analyzing financial data to help internal management make improved decisions to achieve organizational goals. This type of accounting covers a wide range of activities, such as costing products, budgeting forecasting, and conducting financial analysis to provide data regarding business operations. The entire financial accounting process adheres to standard principles and frameworks, such as Generally Accepted Accounting Principles (GAAP) and the Financial Accounting Standards Board guidelines.

This improves the quality of financial reporting and helps the management make better strategic decisions as they have a clear picture of the company’s financial health. It is one of the most important financial statements, giving controls can prevent employee theft a comprehensive overview of a company’s financial position in a given accounting period. It specifically focuses on what the company owns (assets), what it owes (liability), and what remains for the shareholders (equity).

In this way, managerial accounting forms the foundation for sound financial management so businesses can operate efficiently and stay competitive – all while achieving sustainable growth. Whether launching a new product or service, relying on accurate financial data can always help in making an informed choice. It gives you a clear idea of how much you can afford to spend in a particular area without getting into financial trouble. In contrast, managerial accounting’s insights are often highly detailed, in-depth analyses of various cost functions. For instance, managerial accountants are often tasked with reporting on overhead cost absorption.